2 Minute Read:

Overseas imports to the US undergo a legally defined checking procedure. The US Customs and Border Protection (CBP) carry out this process to ensure the shipment complies with import regulations.

Overseas imports to the US undergo a legally defined checking procedure. The US Customs and Border Protection (CBP) carry out this process to ensure the shipment complies with import regulations.

CBP examines imported cargo, preventing FDA non-compliant medical devices, illegal drugs, and counterfeit merchandise entry. The process also requires proper file documentation at the entry terminals describing the products and value.

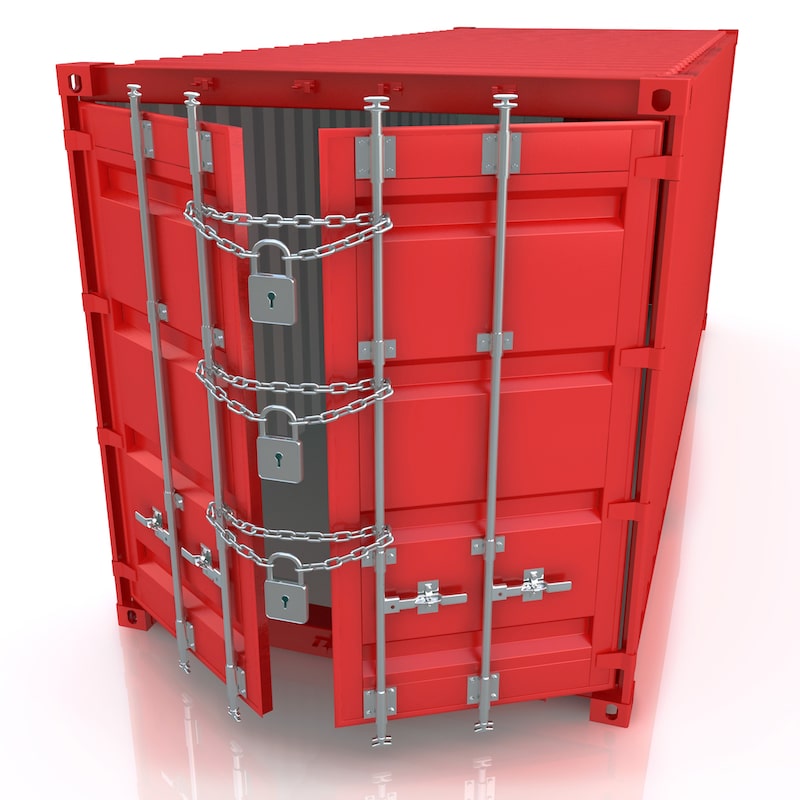

However, if Border Patrol or the US Customs determine your imports have counterfeit, illegal, or undeclared products, they are seized.

What Happens When Your Imports Are Seized?

If your products are seized, you will receive a seizure notification or a visit by CBP agents. But it depends on the intensity of the determined violation.

You are also given seven days to show they are not counterfeit or illegal under the law.

Depending on the products, you may lose them permanently or pay imposed penalties to get them again. Sometimes the seizing authorities may impose penalties up to twice the import’s value.

If your detained goods violate the set imports regulations, they are routinely destroyed. A credible product destruction company like Destruction Central carries out the process.

Also, the cost of destroying is usually recovered from the importing party.

What to Do if CBP Detains Your Merchandise

According to the US Customs and Border Protection, millions of counterfeit products are seized every year. This procedure is vital for the anti-counterfeiting process.

Here is what to do when CBP seizes your products:

Forfeiture Proceedings

US Customs conducts its procedures under strict legal guidelines.

With guidance from an authorized attorney, you can request administrative forfeiture proceedings as stated under the law, 19 USC § 1607 and 19 CFR § 162.45.

Jury Trial

You have the right to seek a jury trial to settle your detained package case in federal courts. Here, the seizing authorities have the burden to prove their reasons for seizure.

You are also entitled to a fair hearing.

Verify if There Are Any Outstanding Taxes

If you use a customs broker for your imports, contact them to check any unpaid shipping taxes. This is mainly for larger shipments of over $2,500 that require a customs broker.

Check for Any Incorrect Paperwork

CBP requires appropriate and correct documentation. If your shipment lacks proper paperwork, your products will be detained. This is because different imports have varying documentation, depending on the value, size, and type. Make sure you have the correct documents to avoid seizure.

What Happens If My Product Is Seized?

Generally, all imports are examined at entry. Any arising issues will lead to product seizure. If you are faced with large quantities of seized products, you will require a product destruction company for safe disposal.

Call us at 909-906-6050 or fill out our online contact form for unmatched product destruction services.